intradaybets@gmail.com

Monday, May 31, 2010

Ericsson

Will short Ericsson if it breaks below today's low and buy it if it will go higher than today's high with a target of .75-.80 SEK.

Friday, May 28, 2010

Friday afternoon

I am finding the markets difficult to trade at the moment. No trades so far today. Might stay out of the market over the weekend.

Thursday, May 27, 2010

Index Update

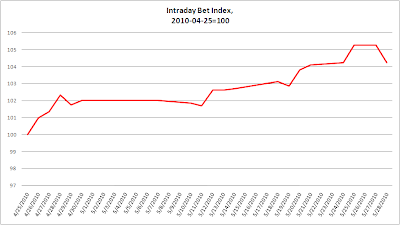

Todays's result is an eight cent loss in Nokia. Posting the intraday bet-index as of today.

The index is based on the average return per trading day.

Trade with you again, tomorrow Friday!

S

Wednesday, May 26, 2010

Today's summary

Both trades were exited at par. Unfortunately BOL went straight to my target right afterwards. Better safe than sorry.

0% and 0%

0% and 0%

Boliden

Will place sell orders in the area 90.40-90.60 and a break even order at 89.15.

Nokia

Selling nokia here. 8.295. N.b. by mistake I wrote at first that I was buying it. Selling it is!

Tuesday, May 25, 2010

Time to summarize today's trading

Nokia was hot! It gave 0.12% yesterday and 1.9% today. Ericsson gave 0.05 SEK or 0.06%.

I suggest we all have ourselves a terrific evening. À bientôt.

S

Buying Ericsson and Nokia

I am buying ericsson B and Nokia if they brake the tops they just formed at 78 and 7.885.

Monday, May 24, 2010

Covered Nokia

at 8.00. was waiting for it to come down a bit more but it's better to make zero profit than a loss..

Monday monday. Might be a fun day

Will short Nokia if it breaks today's low at €8.015.

Friday, May 21, 2010

Friday summary

Could have covered Ericsson earlier (and more cheaply) than at the close but was convinced it was going lower..

Thursday, May 20, 2010

Thursday morning

Good morning.

Will start off the trading day by shorting Nokia at 8.215.

Will start off the trading day by shorting Nokia at 8.215.

Wednesday, May 19, 2010

Wednesday summary

2 small profits and one SCA trade.

ERIC B

+0.12%

NOK1V

+0.36

SCA B

-1.26%

Tomorrow is another day

ERIC B

+0.12%

NOK1V

+0.36

SCA B

-1.26%

Tomorrow is another day

Tuesday, May 18, 2010

Today

So I didn't manage to stay away from the circus and did some car-trading which turned out to be a good idea. Posting an excerpt from excel above. S

the SCA trade

Bought the SCAs. Will try to get rid of them at 88.50 or at the close..

Can Nokia remain this strong?

Not sure. Will sell short at 8.435.

Monday, May 17, 2010

Norway norway

They really know how to celebrate their day these norweigans! Unfortunately the celebrations kept me from trading and from having had a look at the charts it looks like it would've been a lucrative day.

I am giving those of you who master Swedish a nice version of the norweigan national hymn:

Will spend tomorrow travelling but trade with you on Wedneseday!

S

I am giving those of you who master Swedish a nice version of the norweigan national hymn:

Will spend tomorrow travelling but trade with you on Wedneseday!

S

Friday, May 14, 2010

End of second week

+2% and +0.7%

Those are the returns of the first and the second week respectively if I for each day calculate the average return of the trades and then calculate the compounded return. I will use OMXN40 as benchmark which during the period returned -6.3%.

I created the Intraday Bet Index to illustrate the results.

The results of todays trades are: Eric B -1.31%, Nokia 0.90%, SCA, 0.68%. I might not trade on Monday. Norway is calling with a good party. Anyway, enjoy the weekend and trade with you again soon!

Those are the returns of the first and the second week respectively if I for each day calculate the average return of the trades and then calculate the compounded return. I will use OMXN40 as benchmark which during the period returned -6.3%.

I created the Intraday Bet Index to illustrate the results.

The results of todays trades are: Eric B -1.31%, Nokia 0.90%, SCA, 0.68%. I might not trade on Monday. Norway is calling with a good party. Anyway, enjoy the weekend and trade with you again soon!

Profits!

I covered Nokia at €8.40 and will cover SCA at 88.10.

Trade Update

Nokia is weak this morning. I am hoping to get it pushed down to €8.40-8.41 where I will cover.

New trades

Today I will trade Nokia and Ericsson. Started by shorting Ericsson at 80.4

Wednesday, May 12, 2010

Holiday again

Today's trades were: Nokia -long at €8.645, sold at €8.72, SCA B - long at SEK89.60, sold at 90.45. The trend during the morning was strong and the trades correspond to profits of 0.87% and 0.95%

respectively.

Now, time to relax for one day and then back on it!

Levels

I will give you some levels:

SCA Buy 89.60 Short 88.90

Nokia Buy 8.645 Short 8.575

Tuesday, May 11, 2010

Lucky shot

I was just so close to stopping my Nokia trade out, but the indices turned just there and I was able to follow it down a bit and make a profit instead. SCA was crap. Today's and yesterday's results: SCA -1.23% and 0.96%, .. Nokia 0.93% and -1.27%

Nokia

Will cover my nokias (that I shorted at 8.62) at 8.55-8.54

Tuesday

I have started the day by buying SCA at 89.60. Will short Nokia if we will see a 8.62 on the ticker ..

Monday, May 10, 2010

Log reopening

It's monday and time to trade again. I have started off this week by buying SCA at 88.70 and shorting Nokia at 8.67.

Saturday, May 1, 2010

First of May holiday

The author of this blog would like to thank you for the first week and hope that the May 1st holiday will do you all good. I will actually take a whole week of holiday. I suggest you spend some time until the next post here looking at some fine contemporary art as the auction houses in Stockholm now are full of it. I fell in love with the lady below that can be seen at Bukowskis in Stockholm

I also thought I should take the time to summarize the trades during the first week. They gave a additive return 4% gross of commission. I have chosen to leave commission out in the calculations. Traders have commission rates of anything from 30 to 0.5 basis points and it would strike very differently depending on which rate that is used. The main reason for leaving them out here is convenience.

Last, some words about the trading methods. I try to capture a trend intraday. If the trading universe would only consist of intraday trades this method would be the opposite to scalping. The entry and exit points used are made up of technical levels that are found in the price charts.

Enjoy your holidays folks,

trade with you in a week!

Subscribe to:

Posts (Atom)

Disclaimer

The investment ideas described above are only for the purpose of logging my own trades and trading ideas and are not to be taken as investment advice.